The opportunities and risks of stock market financing for young solar thermal companies

July 12, 2021

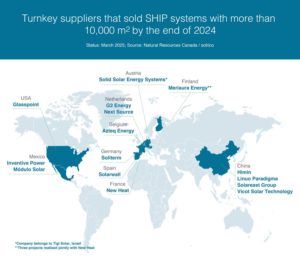

More and more solar thermal companies are financing their growth by issuing shares. The most recent example is Tigi from Israel with its IPO on 21st March 2021. Some Scandinavian project developers such as Absolicon, Savosolar and Clean Industry Solutions Holding Europe as well as the Chinese Solareast Holding with its brands Sunrain and Micoe have been stock market listed for several years. We talked to the Editor-in-Chief of the investment newsletter Öko-Invest about the opportunities of equity financing for the solar thermal sector and the risks for investors. Max Deml, who is Bavarian but lives in Vienna, has been analysing stock market listed regenerative energy companies for more than 30 years and in addition to the annual Öko-Invest Solar Shares Study publishes the Green Money Handbook (currently in its eighth edition). Both publications are available in German only. This is the first in a series providing news about stock market listed companies in the solar thermal industry.

Photo: Michael Rausch-Schott

Solar thermal companies often have problems in finding institutional investors willing to provide the necessary capital to get past the investment-intensive start-up phase. What opportunities do stock market listings offer?

Deml: In this industry it doesn’t make much sense to expect to get money through an IPO during the start-up phase if the annual turnover is under a million or the potential achievement of profitability is still a long way off. Tigi, the nine-person company you mentioned, however, did manage to raise almost 9 million EUR through its stock market debut with a turnover of around 1 million EUR and a loss of 230,000 EUR in 2020. At the current share price of around 31 NIS (Israeli New Shekel) the company already has a stock market value of 32.5 million EUR (see table at the end of the news). This could, however, fall rapidly if the expectations for a continued high rate of growth are not fulfilled or future annual profits do not reach the seven-figure level soon.

Would you encourage solar thermal companies to include an IPO in their concept for seed financing?

Deml: Yes, because it makes it more interesting for seed investors if they can potentially sell their shares at any time after the IPO.

What should new companies consider when striving for a stock market listing?

Deml: There are many important aspects, from the legal requirements and the cost of the IPO via the setting of an issue price that is attractive for the market and therefore acceptable, to the subsequent publication obligations and shareholder relations. But the management must also consider the future structure of the shareholders. Whereby it is important to decide whether, or under what conditions, the founder team is prepared to give up their majority shareholding.

Overview of selected stock market listed companies. You find additional business parameters in the table below. Source: Öko Invest / company information

Which support should the founders of the company enlist in order to master these structural challenges?

Deml: Good consultants – and also the bad ones – are usually too expensive for smaller companies. This makes it even more important that the people in the management and on the Supervisory Board have sufficient competence and experience themselves, for example to find a suitable bank with which to organize the IPO or to select the stock exchange on which the initial listing of the shares seems to make the most sense.

Stock market listed companies have to fulfil strict requirements in terms of communicating the company’s accounts and its activities. Does this make the company weaker because its competitors can also use this information?

Deml: In individual cases this can be a disadvantage, but generally the advantages of a successful IPO greatly outweigh the disadvantages. Without their share issues, companies such as Apple and Microsoft would not have been able to expand as they did and would not be worth billions of dollars today.

There are far fewer solar thermal companies listed on stock markets than companies from the wind energy and PV industries. Why do you think this is?

Deml: Apparently, many solar thermal companies have not been attractive enough for investors so far because they are too small, their margins are too low, they depend too much on political conditions or subsidies, or their business models are not as easily scalable as in the PV sector, for example. Also, there is no precedent for high price gains in this sector as there has been in PV. Between 2002 and 2007 the shares of Solarworld AG, a German PV cell and module manufacturer, shot up from 0.25 EUR to 50 EUR, a gain of 19,900 %. In contrast: the share price of the Swedish company Clean Industry Solutions Holding Europe, to which the German companies Industrial Solar and SolarSpring belong, has fallen from more than 15 Swedish krona (SEK) to currently less than 5 SEK within one year, thereby pushing the market capitalization of the company below 6 million EUR. The shareholders of the Finnish company Savosolar have lost even more: over the last six years the share price has fallen from around 20 EUR to 0.10 EUR now. No wonder: in 2020 Savosolar recorded a loss of 5.0 million EUR on a turnover of 5.1 million EUR.

What risks are shareholders taking if they invest in start-up solar thermal companies?

Deml: As with any other share, there is the risk that the company will have to register insolvency – which usually means in the end, if one hasn’t sold the shares previously, that 100 % of the invested money is lost. For example, after the insolvency of the German company Solar Millennium AG in December 2011, which in addition to shares also financed itself through bonds and closed-end funds, around 30,000 investors lost a total of 250 million EUR. The company was specialized in the development of solar thermal power stations. And also in the case of the now insolvent Solarworld AG, which at its peak in 2007 – with annual sales of over one billion EUR and profits of over 100 million EUR – was worth over 5.3 billion EUR, the share is now a “penny stock”.

The risk of losing money in this industry is large but there are chances as well if you pick up the right stock at the right time. Next year we will analyse the solar thermal stocks in a special issue of our stock market newsletter: let’s see whether we can recommend one of the stocks!

Business parameters of the selected stock market listed solar thermal companies

Source: Öko Invest / Publicly available financial data

More information (only in German): https://oeko-invest.net/