Portugal: Incentive Programme with Obstacles

May 25, 2009

At the moment, the most important factor for the sales success in Portugal is to either be able to join the incentive programme – or to be left out of it. Only seven companies acquired the programme’s membership so far (as of mid-May): The three Portuguese brands Norquente, Openplus and Solargus, the Vulcano brand of the German heating giant BBT Thermotechnik, Wikora, which is a German solar thermal system supplier, and Rigsun, a brand from Greece.

Sonnenkraft, the system supplier from Austria just joined in the middle of May, two-and-a-half months after the incentive scheme had been launched.

Left out are many companies, for example Solahart. “Portugal was one of our best sales markets, but now we are not registered with the incentive programme,” Rob Reijnen from the European sales office of the Australian manufacturer says. This is why the European Solar Thermal Industry Federation (ESTIF) has raised concerns over the programme’s procedures, the lack of transparency and the result in unfair competition – also towards the European Commission.

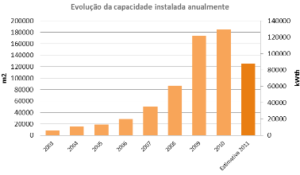

What has happened until now? This February, the Portuguese government announced a huge incentive programme for solar water heaters with a budget of € 95 million, planning to subsidise 300,000 m2 of newly installed collector area within one year. The support scheme foresees a rebate of € 1,600 per system – for pumped and thermosiphon systems and not depending on their size. This rebate can be combined with a 30 % tax credit from the Portuguese government for investments in renewable energies.

In this very first announcement, the Portuguese government demanded criteria which could only be fulfilled by a small number of players in the market: A participating company needed to be able to produce and install 50,000 m2 per year and perform at least 2,000 installations per month throughout the entire Portuguese state. A Solar Keymark for the thermosiphon system with 200 and 300 litres was another requirement of the scheme, which was very difficult to fulfill by many market players in Portugal (you find further details about the programme in the database of incentive programmes).

After having been pressured on all sides by industry, press, the national association Apisolar and entities from other EU countries for some time, the Portuguese government finally started to move. It implemented a new scheme for small and medium enterprises (SMEs), which requires them to produce only 500 m2 of collector area per year. The Solar Keymark for thermosiphon systems was not mandatory for SMEs. This SME scheme, however, limits the subsidised collector area to a total of 50,000 m2 (you find further details about the programme in the database of incentive programmes).

“Our chance came in March, when the government decided to postpone the requirement for labelling the whole thermosiphon system until the beginning of 2010,” Stefan Hattler, sales manager at the Wikora company, which joined the incentive scheme, says. The European standard of classification of SMEs states that independent companies should have with fewer than 250 workers and an annual turnover of below € 50 million.

Still, ESTIF and Apisolar have not been very pleased with the regulations of the incentive programme. Why a big lack of transparency?

First, the government gave several local banks the permission to run the project and sell the subsidised systems. That means that the end consumer can not choose a system supplier directly. If he or she wants to benefit from the subsidy scheme, the home owner has to purchase the system through one of the selected banks (see links below).

Secondly, the banks agreed to hire a private company to deal with the applications of system suppliers. Right now, the Portuguese entity Pmelink decides whether a system supplier fulfils the requirements. “It took them 2 months to publish a website with information about these subsidies. Nonetheless, it still doesn’t provide clear information on the procedures a supplier has to go through to access the scheme,” says ESTIF’s Pedro Dias. The website http://www.medidasolartermico2009.com was launched at the end of April and finally made the list of approved system suppliers available to the public.

More information:

Pmelink: http://www.pmelink.pt

Links to banks, which sell the approved solar water heating systems at a reduced price and advertise them on their website.

Caixa Geral de Depósitos

http://www.cgd.pt

Banco Espírito Santo, SA

http://www.bes.pt

Banco Comercial PortuguêsS.A

http://www.millenniumbcp.pt

Banco BPI

http://www.bancobpi.pt

Banco Santader Totta

http://www.santandertotta.pt

Estatutos Montepio

http://www.montepio.pt

Banif – Grupo Financeiro

http://www.banif.pt