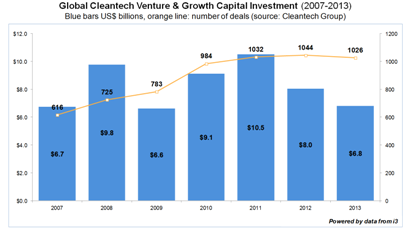

The Cleantech Group tracks all Cleantech venture & growth capital investments worldwide. The chart shows the up and down of the global cleantech venture and growth investment in the last […]

Solar thermal technology is said to offer enormous potential over the coming decades. However, to grow and develop a technology, you need investments, and these investments are hard to come […]

Solar thermal is not just about technology, it´s also about financing. It takes much more than just an improved, mature technology to have a successful industry. It needs new business […]